The Briefing Leaders Rely On.

In a landscape flooded with hype and surface-level reporting, The Daily Upside delivers what business leaders actually need: clear, concise, and actionable intelligence on markets, strategy, and business innovation.

Founded by former bankers and veteran business journalists, it's built for decision-makers — not spectators. From macroeconomic shifts to sector-specific trends, The Daily Upside helps executives stay ahead of what’s shaping their industries.

That’s why over 1 million readers, including C-suite executives and senior decision-makers, start their day with it.

No noise. No jargon. Just business insight that drives results.

For decades, Porsche was the poster child of automotive excellence; a brand synonymous with precision engineering, iconic sports cars, and enviable profitability. Yet the past half-decade, from 2020 through 2025, has tested the Stuttgart-based automaker more than any period in its modern history. The trouble didn’t arrive overnight. It began quietly in the early 2020s as the global automotive landscape shifted under the weight of electrification, regulatory change, and macroeconomic pressures. Porsche, long a champion of high-performance combustion engines, embraced electrification with optimism, launching the Taycan, its first fully electric sports car, to critical acclaim. But the next chapter would prove far more turbulent.

The Porsche Taycan

By 2022–2023, Porsche still looked healthy on paper. The company delivered a record 309,884 vehicles worldwide in 2022, building on growth from 2021 when it had already set new delivery highs led by SUVs like the Macan and Cayenne. China, the U.S., and Germany were its biggest markets. Yet beneath those numbers, early warning signs appeared: Porsche’s electrified vehicle share was rising slowly, but it wasn’t keeping pace with competitors, particularly in China, a market increasingly dominated by nimble local EV makers. Revenues remained strong, but strategic tensions were forming between Porsche’s tradition of combustion excellence and tomorrow’s electric future.

The Porsche Cayenne S

The turning point began in 2024 and through 2025, when Porsche’s core business, once the epitome of profitable luxury car-making, began to unravel. Strategic realignment and electrification costs alone created a massive financial burden: Porsche had invested heavily in new EV platforms and even in-house battery production, only to realize that market demand was weaker than expected. The company shelved its ambitious battery plans and postponed several EV launches, redirecting resources to hybrid and combustion models. At the same time, China, once Porsche’s crown jewel, became a problem rather than an engine of growth. Sales in China dropped roughly 28% in 2024 and continued to decline in 2025 as local competitors offered more attractive, tech-forward EVs. Porsche responded by cutting its dealership network and winding down parts of its proprietary charging infrastructure, a dramatic reversal for a market that had fueled the company’s profits for years. Meanwhile, U.S. import tariffs forced Porsche to either absorb higher costs or raise prices, further reducing profitability. Finally, slower-than-expected adoption of high-end EVs globally meant Porsche was paying the full cost of electrification without the offset of strong consumer demand.

The Porsche 911 GT3 RS

All these pressures came to a head in the third quarter of 2025, when Porsche reported an operating loss of €966 million ($1.1 billion). This was its first deep quarterly loss in decades. Operating profit for the first nine months of the year had collapsed by roughly 99%, from around €4 billion the previous year to just €40 million. CFO Jochen Breckner described 2025 as a “trough year,” emphasizing that Porsche was absorbing short-term pain to reset for long-term resilience. Leadership changes followed: CEO Oliver Blume announced his departure, and Michael Leiters, a veteran engineer with experience at McLaren and Ferrari, was brought in to guide Porsche through its reinvention. The strategy now balances electrified models with hybrids and combustion engines, while cutting costs through restructuring and job reductions.

Oliver Blume the current CEO

Michael Leiters the new CEO as of January 1st 2026

Before this crisis, Porsche’s annual deliveries were strong: roughly 280,000 vehicles in 2019, 270,000 in pandemic-struck 2020, and more than 300,000 annually in 2021 through 2023. The brand’s top sellers have consistently been SUVs like the Macan and Cayenne, with iconic sports cars such as the 911 continuing to capture the public’s imagination. China historically accounted for the largest share of Porsche owners, followed by the U.S. and Germany. Electrified vehicles have grown steadily in share, but the challenges of global tariffs, market competition, and shifting demand have made growth uneven.

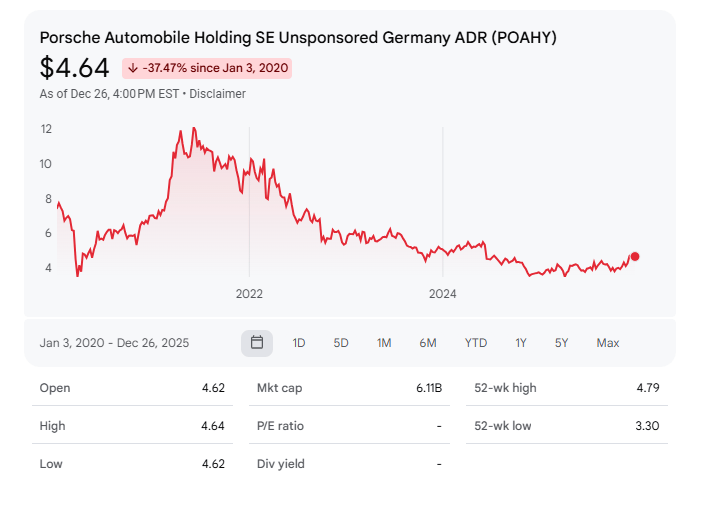

The stock price of Porsche over the last few years

Porsche at a Glance — Key Sales & Production Data (2019–2024)

Year | Global Deliveries | Top Selling Model | Notes |

|---|---|---|---|

2019 | 280,000+ | Cayenne / Macan | Pre-pandemic strong growth |

2020 | 270,000+ | Macan | Pandemic impacts, resilient SUV demand |

2021 | 301,915 | Macan | Record deliveries |

2022 | 309,884 | Cayenne | Continued growth; China largest country |

2023 | 320,000+ | SUVs & 911 | Margins strong; robust profit |

2024 | 310,718 | Cayenne (global) | Electrification share rising |

(China was historically Porsche’s largest individual market before 2024.)

Despite the turbulence, Porsche is far from finished. The company continues to innovate, sell its most beloved models, and leverage its engineering heritage while recalibrating for a world in which both electrification, combustion engines and global market forces dominate. What happened in 2025 was a reckoning, a rare moment where strategy, timing, and global forces collided. Porsche’s resilience will now be measured not by how it maintained its historical margins, but by how it navigates this era of transformation, balancing tradition with the pressing realities of an electrified and highly competitive automotive world. Takeaway Even long-term success doesn’t protect you from change, it just delays the moment you must confront it. Real resilience, in business or life, means accepting short-term setbacks so you can adjust early, instead of staying comfortable until change forces you to move. As always, I’m rooting for you!

The Porsche 992 GT3 RS